delayed draw term loan accounting

The delayed draw term loan of each term loan lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending following the first. Accounting for a debt modification and debt extinguishment when the lender remains the same ASC 470-50-40-10 and ASC 470-50-40-11 provide guidance on whether a modification or.

Tree Line Capital Partners Linkedin

The withdrawal periods.

. Hence they avoid paying. سحب قرض محدد آخذه في تاريخ لاحق - سحب مسبق لقرض محدد آجل اىستحقاقه بتاريخ لاحقمتأخر. 34 Modification Or Exchange Term Loan And Debt Security 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents -i- LIST OF SCHEDULES AND EXHIBITS -ii- -iii- CREDIT AGREEMENT dated as of November 16 2010 between. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the. During the Delayed Draw Commitment Period subject to the terms and conditions and in reliance upon the representations and warranties set forth herein each.

I unless otherwise agreed bythe administrative agent and the lendersin their sole discretion delayed draw term loans shallbe made in an aggregateminimum amountof 2500000 and. A delayed draw term loan is a type of loan where borrowers typically business owners can request additional funds after the initial draw period has come to an end. Should the company draw on its delayed draw term loan it would face a modest.

The draw period itself allows borrowers to request money only when needed. Unlike a traditional term loan that is provided in a. November 12 2021 What are Delayed Draw Term Loans.

The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

If a lender waives a covenant violation for no consideration either explicit or implicit no accounting is required under ASC 470-50-40 because there is no change in cash flows. Delayed Draw Term Loan. DDTLs were used in bespoke arrangements by borrowers.

Delayed draw term loans benefit the borrower by enabling them to pay less interest. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial. A delayed draw term loan DDTL is a special feature in a term loan that allows a borrower to withdraw predefined amounts of a total pre-endorsed loan amount.

A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. Delayed draw term loan accounting Monday April 18 2022 Edit 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting. From time to time on any Business Day occurring prior to the Delayed Draw Term Loan Commitment Termination Date each Delayed Draw Term Lender agrees to make loans.

Loan Journal Entry Examples For 15 Different Loan Transactions

2 2 Accounting For A Guarantee Under Asc 460

Short Term Loan Receivable Bookkeeping Simplified

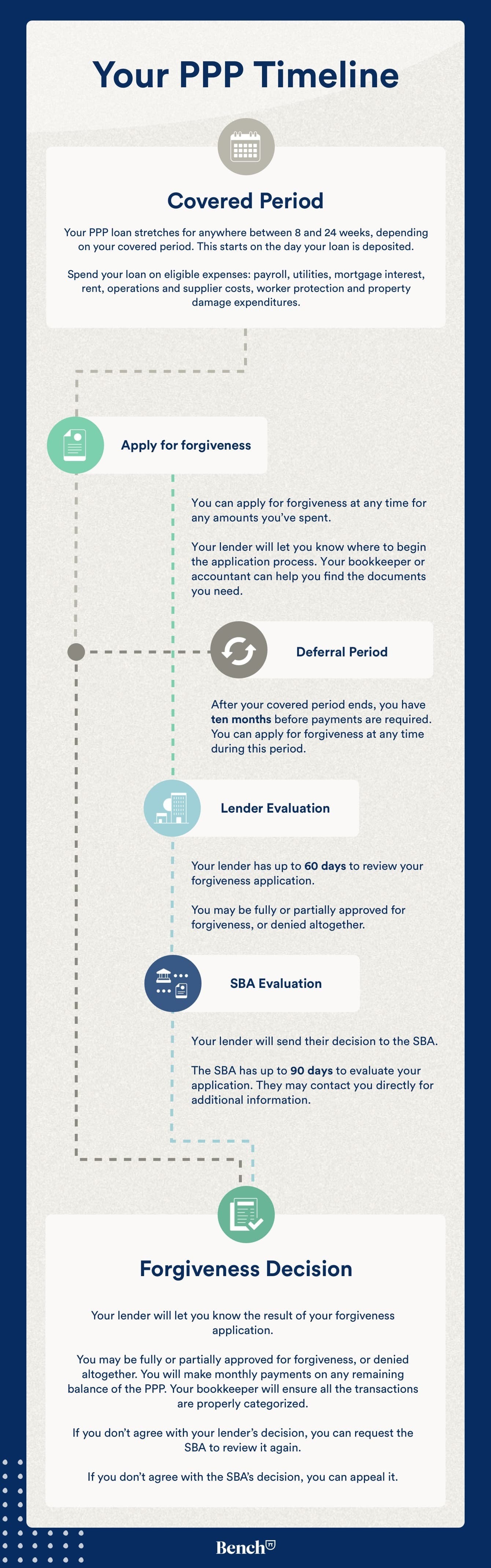

When Can I Submit My Ppp Loan Forgiveness Application Bench Accounting

What Are Delayed Draw Term Loans Ddtl The Full Guide Saratoga Investment Corp

:max_bytes(150000):strip_icc()/106540074-5bfc2dfdc9e77c0058778026.jpg)

Delayed Draw Term Loan Definition

Lines Of Credit Types How They Work How To Get Them

Glass House Brands Secures Us 100 Million Senior Secured Term Loan

Leveraged Loan Primer Pitchbook

Leveraged Loan Primer Pitchbook

Frequently Asked Questions For Federally Insured Credit Unions Ncua

What Is Construction Escrow Flexbase

How To Calculate An Interest Reserve For A Construction Loan Propertymetrics

5 4 Analysis Of An Embedded Equity Linked Component

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

Sponsors Holster Revolvers For Delayed Draw Loans Churchill Asset Management